You may have received your 2023 Estimate of Value from your local taxing authority this week and we know you have some questions. We wanted to take a moment to try and answer a few of the top questions we’ve received.

Property Tax Valuation FAQ:

Does this mean my taxes will go up?

Not necessarily. So how does that work? So imagine the City of Oz has an annual budget of $100,000 and it is divided between the 100 houses in its city limits and each property is valued equally at a $100,000. The tax rate is 1% and each house pays $1,000. Say in 2023, the Ozonians receive estimates of values and they doubled $200,000. However, the City has not approved a higher budget, then the $100,000 is still divided among the houses and the tax rate decreases by 1/2 to 0.5% and the citizens still pay $1,000 per year in property taxes.

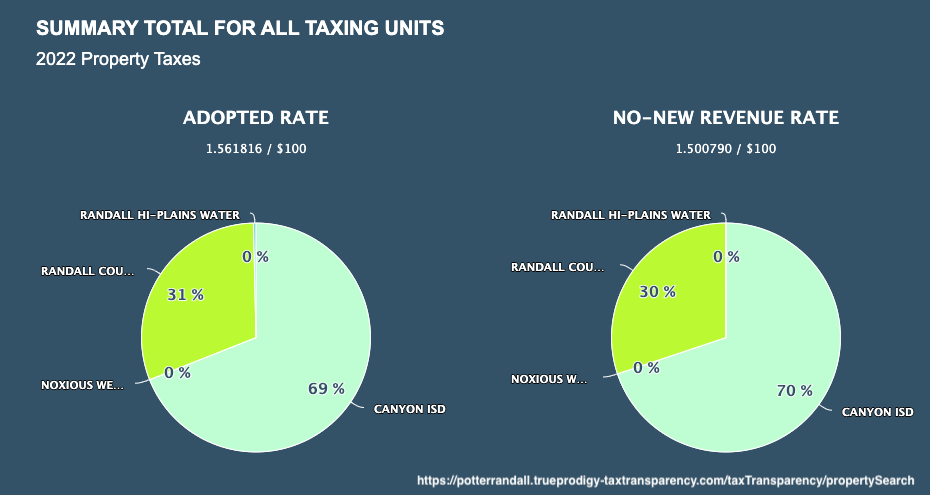

Just like in the example above, more weight is given to certain neighborhoods based on real market trends and so some neighborhoods may have seen more of a hike in their values and some neighborhoods may even see their values drop slightly. According to the Potter Randall Appraisal District, the average across all properties in Texas saw an increase of about 10%. See the figure below that shows the tax rate decreases from 1.562 to 1.501 for a property in Randall county No-New Revenue Rate is kept after the property value has increased. As a whole, the properties share a burden of the taxing jurisdiction’s budgets. Some common jurisdiction’s you might see on your tax bill are: county, city, community colleges, water districts, etc. Final budgets will come out during the summer. If you live in Potter Randall county there is a website to search your property and see if there are any proposed budget changes. There will be links to contact the jurisdiction or public meeting times for you to attend. Tax Transparency in Texas

I thought my valuation could not increase more than 10% from year to year?

That’s partly correct. This is known as the “Homestead Cap”. IF you have a homestead exemption on your property, the assessed market value on the tax letter may be more than a 10% increase since last year. However – read further down in the letter you received and there should be a Net Tax Appraisal amount. This should have only increased by no more than 10%. This is what will be multiplied by the tax rate to determine how much you’ll pay. Note: It does not go into affect until the January 1st after you qualify. Ex. You purchase a home on December 20, 2021. You qualify for homestead exemption on Jan. 1 2022 so the “Homestead Cap” does not take affect until Jan. 1 2023.

What are my options going forward?

#1 MAKE SURE YOU HAVE FILED A HOMESTEAD EXEMPTION

You can file a late application for a homestead exemption up to 2 YEARS AFTER the delinquency date (typically February 1st) or FIVE YEARS AFTER for disabled veterans. File before April 30 to have the exemption for the current year. You can qualify for the exemption starting the January 1st after you purchase the property.

#2 PROTEST THE TAX APPRAISED MARKET VALUE

If you have EVIDENCE to why the value is higher than it should be, you have the right to protest this amount. The form can be found on the County Appraisal District Website. Or you can visit this link to download. Deadline to file is May 15.

#4 PARTNER WITH YOUR LOCAL ELECTED OFFICIALS

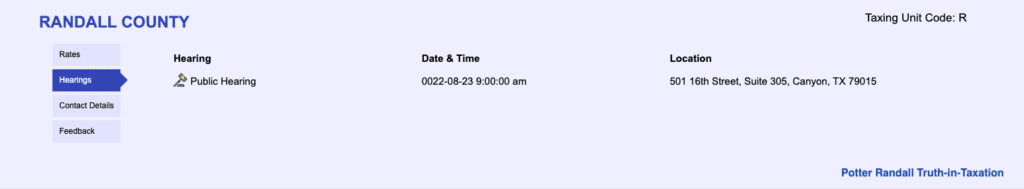

Become aware of the different taxing districts to which you pay your taxes to and learn the pros and cons of the proposed BUDGET changes that affect your share of taxes. Most properties fall into these taxing districts: County and School District (and City if you are in city limits). There are other districts that may affect your tax rate (seen on your tax bill) such as a Community College, Public Improvement District, or Water District. You can find hearing information and contact details at the Potter Randall County Tax Transparency website.

#3 VOTE FOR TEXAS PROP IN NOV 2023

Vote YES for Texas Proposition likely to make it to the ballots in November 2023 that will raise the homestead exemption from $40,000 to $70,000! Voters passed a similar proposition about one year ago in 2022 that raised homestead exemption from $25,000 to $40,000.

Texas Senate also wants to TRIPLE the exemption seniors receive from $10,000 to $30,000. If both exemptions pass, ten seniors would not be taxed on the first $100,000 of their home value.

For questions about your tax letter or filing your protest, contact your local Appraisal District office. Just keep in mind though that the staff in the appraisal district office are receiving a lot of angry phone calls, so be nice and ask good questions. They are dealing with a lot of misinformed and ANGRY people right now. This is a nationwide issue not just in Potter / Randall County.

“If you want to gather honey, don’t kick over the beehive.” – Dale Carnegie

Resources:

Potter / Randall Tax Exemptions

Potter Randall County Tax Transparency

Texas A&M Real Estate Article on Tax Appraisals