How did the 2021 housing market compare to 2020?

Most people are interested in the price of a home, either what you will have to pay for it or what you might be able to sell  yours for today. For the state of Texas, the average gain in home equity was about $43,000 over the last year according to CoreLogic. Locally, the average cost of new construction from 2021 compared to 2020 was up about 15.7% according to the Amarillo MLS Data.

yours for today. For the state of Texas, the average gain in home equity was about $43,000 over the last year according to CoreLogic. Locally, the average cost of new construction from 2021 compared to 2020 was up about 15.7% according to the Amarillo MLS Data.

At the end of 2021, 4,779 homes had sold in all of 2021 in the Amarillo area, up 11.5% from 2020 numbers. Sales were up, but the number of active listings on the market at the end of December 2021 was down about 22% from end of 2020. The inventory issues are far from normal. For perspective, in the heat of the summer when inventory levels are typically at its highest, July 2019 there were 1,586 homes on the market. This previous July (2021), there were only 696 homes on the market. That is less than half the inventory our area is used to.

What will interest rates look like in 2022?

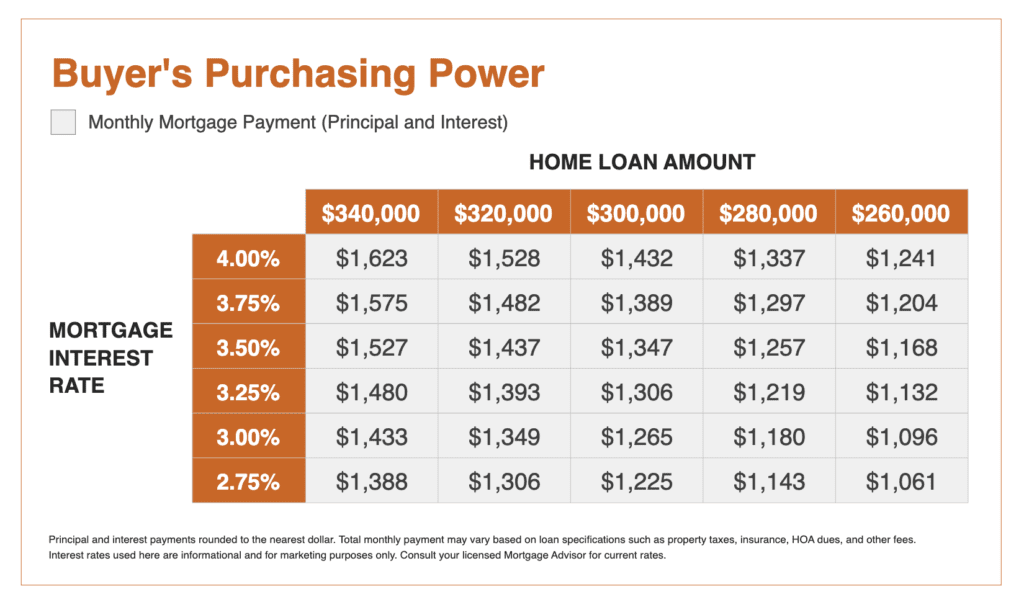

Looking ahead, the biggest question on everyone’s mind is how the interest rates will look this coming year. At the end of January, we are already seeing 30-year Conventional rates of 3.875% offered locally. That is up from the beginning of this with 30-year Conventional rates of 3.5%. Those numbers do not really mean anything though until you compare against what an actual monthly payment would be, so let’s take a look.

The table below breaks down the loan amount into monthly payments including principal and interest (before tax and insurance). You will see the different interest rates on the left and loan amounts across the top. For a $300,000 loan, a 0.5% increases the monthly payment by just under $100. But, if home prices continue to rise, as they are expected to in addition to a rise in interest rates, a $20,000 home loan increase plus 0.5% interest rate increase raised the monthly payment by just under $200.

Will home prices fall or go back down?

We get this question a lot from prospective home buyers or that they plan to wait out the market when it crashes. Unfortunately for buyers, it is not likely that home prices will go down. It is expected that home prices continue to rise over the next few years and for 2022, on average, experts are forecasting home prices to appreciate around 5%. The reason why prices will continue to rise is from a combination of steady increase in demand and continued low inventory. As mentioned about, our inventory continues to stay well below half of what it was pre-pandemic in the Amarillo area. The growth rate is also expected to still rise thanks to industry growth bringing in new jobs.

New home construction is still slowed because of availability of materials and labor. Lumber prices over the last month went back up which only hurts (or helps, depending on how you look at it) home prices across the board. New home prices and sales directly affects existing home sales. As the inventory and price goes up for a new house, this pushes up the demand for an existing build. Despite the increase in interest rates, there is still going to be a need for homes in Amarillo as buyers move in. 2022 will remain a Seller’s Market.

Resources:

http://www.freddiemac.com/research/forecast/index.page

https://www.corelogic.com/intelligence/u-s-home-price-insights/